PAYROLL

How does it work?

Send us your payroll data

Every pay period (weekly, bi-weekly, four weekly or monthly) our reminder system will request the data we need to process the payroll for you, which means you can focus on running your business without having to remember when you need to get the information together to pay your employees.

Advise us of your starters and/or leavers

We can supply you with new starter forms, this will make it much easier to ensure you collect everything you need when you employ a new person and ensure employee details are registered correctly with HM Revenue and Customs for PAYE & NIC purposes. We will process any employees who leave to ensure the accuracy of the final payments and deductions (e.g. pro-rated salary, holiday pay, childcare vouchers) and produce forms P45 for these employees.

Processing your payroll

We will take care of this and ensure your payroll is processed before the deadline We will carry out all the calculations based upon the information you supply to us which means you can be sure you are paying the correct amounts to your employees. This will include the calculation of statutory payments and other voluntary deductions such as pension contributions.

Calculate payments due to HM Revenue and Customs

These calculations will include PAYE, National Insurance, Student Loan, Employer allowance and Statutory Maternity Pay recovered. This will ensure you pay across the correct amount to HM Revenue and Customs every month and avoid any penalties and interes

Ensure compliance with the latest payroll legislation

Tax and payroll legislation are constantly changing but you can leave those worries to us and focus on building your business.

Provision of detailed electronic payslips

If you prefer you can opt for password protection or hard copy payslips. We will also keep detailed records for PAYE inspection purposes.

Submit Real Time Information to HM Revenue and Customs and submit the final end of year RTI declaration.

For each pay period we will carry out a Full Payment Submission and Employer Payment Summary. At the end of each tax year you must submit certain information to HM Revenue and Customs, but we will take care of this for you.

Provide year-end P60s for each employee.

As well as payslips, you must provide every employee with a P60 at the end of the tax year, and once again we will do this for you.

Benefits of having a Payroll Service

Below are 9 key benefits of letting us take care of your payroll:

1

Leaving us to deal with your payroll takes away all the headaches and frees up your time to focus on running your business

2

You can sleep at night knowing you are complying with the RTI legislation

3

You will know your payroll is submitted on time and that means you don’t need to worry about the severe penalties issued by HMRC.

4

Professional payroll advice is just a phone call away

5

Less stress as we take care of the complicated bits

6

Improved record retention for PAYE inspection purposes

7

No internal payroll software and reduced IT costs

8

Online Portal to view payslips online

9

Enhanced data confidentiality

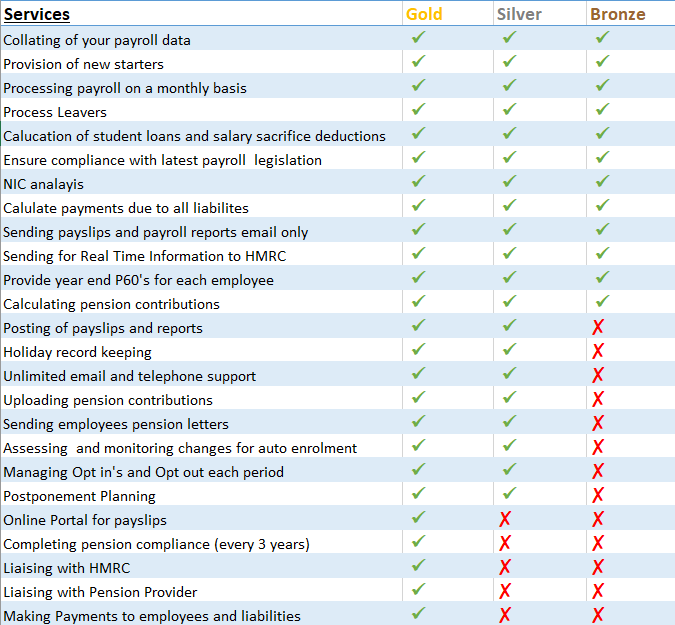

Here are our 3 Payroll services…

Whatever your size, you will find one of our payroll options to suit your needs. The table below summarises what is included within each of our payroll service levels. To help identify the best option for you here is a quick overview

Please get in touch for more information and an personalised quote